Source of funds: Wallet Relationships

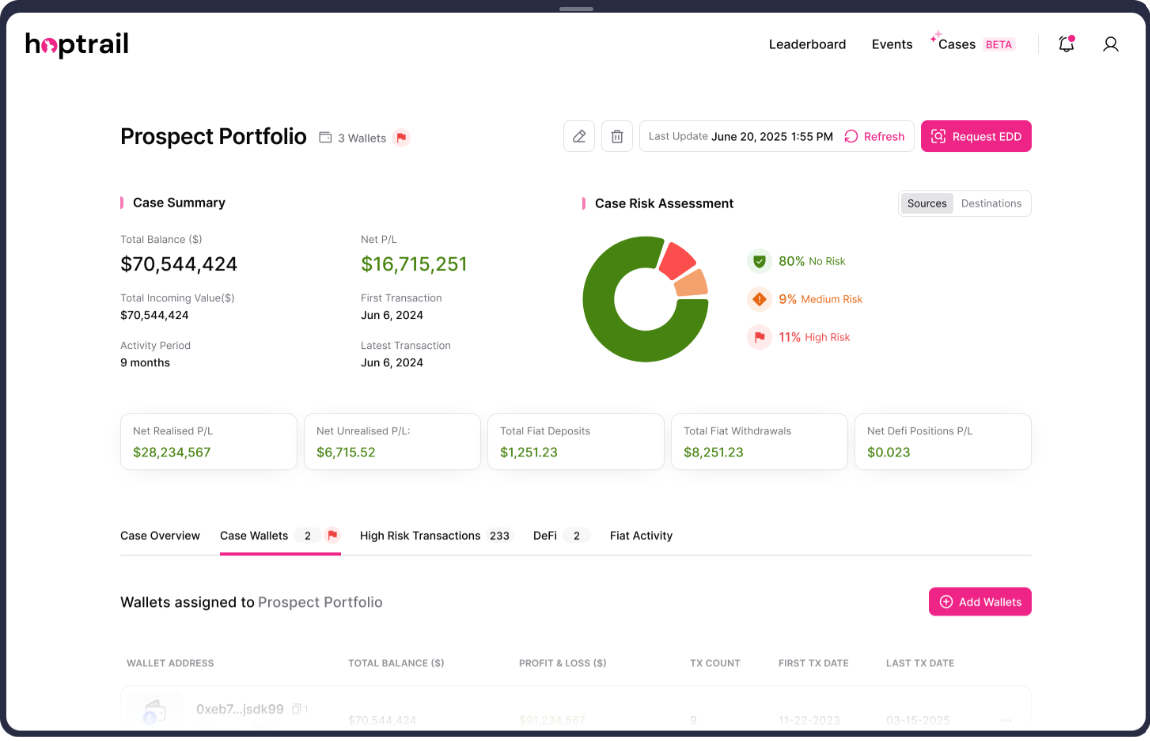

The key to crypto source of funds is understanding the client’s ecosystem from both an economic and a risk perspective. In simple terms this equates to:

- how did they make their money?

- did they touch any red flags along the way?

The answers to both can be derived from blockchain data.

But surfacing and structuring that data in the right way is critical to ensure that checks are efficient, thorough, and scalable. Getting it right will cut time spend onboarding by days if not weeks. It will also significantly reduce the decision-making complexity when faced with questionable counterparties or potential risks.

Hoptrail’s mission always has been to provide traditional finance and other participants in the crypto ecosystem with a robust mechanism to answer these questions. Our most recent updates move us closer to that goal.

Wallet Relationships

Users can now analyse underlying transfers between two counterparties - at an entity and an address level.

What does this mean? Well, when searching an address, instead of just seeing that funds come from Binance and Coinbase, users will be able to interrogate the underlying transactions between your address and Binance and Coinbase. This includes:

- Amounts - how much was transferred (in total and at an address-level)

- Frequency - how many times an address has traded with an entity

- Timestamps - the time-range that those transfers took place

- Direction - whether those transfer were incoming or outgoing funds

- Proximity - whether that relationship is direct or indirect

For those already using the platform, the function can be accessed via the Tx Count column on the sources of funds table.

Why does this matter?

The wallet relationship tool enhances source of funds analysis. If a customer provides information that they traded across specific services, you can verify this. If a counterparty claims to have generated wealth trading on Uniswap, you can analyse the transfers.

If you spot a potential red flag, you can use the tool to assess to what degree this is an issue and whether there are mitigating factors. If they claim to have bought NFTs on OpenSea, you can see how much has been deposited and withdrawn.

The tool is also useful in obtaining detail on a customers’ broader ecosystem, their key relationships, their fund flows - seeing the counterparties and the frequency of the transfers provides insights on their probity.

We view this as critical for those firms dealing with crypto for the first time, to onboard a customer with crypto assets, to assess a counterparty’s source of funds, or to screen wallets prior to receiving funds as an AML tool.

Get in touch with us if you’d like to know more about Hoptrail’s risk analytics platform and our efforts to provide end-to-end source of funds solutions.

Crypto HNWIs: who they are and how they made their wealth

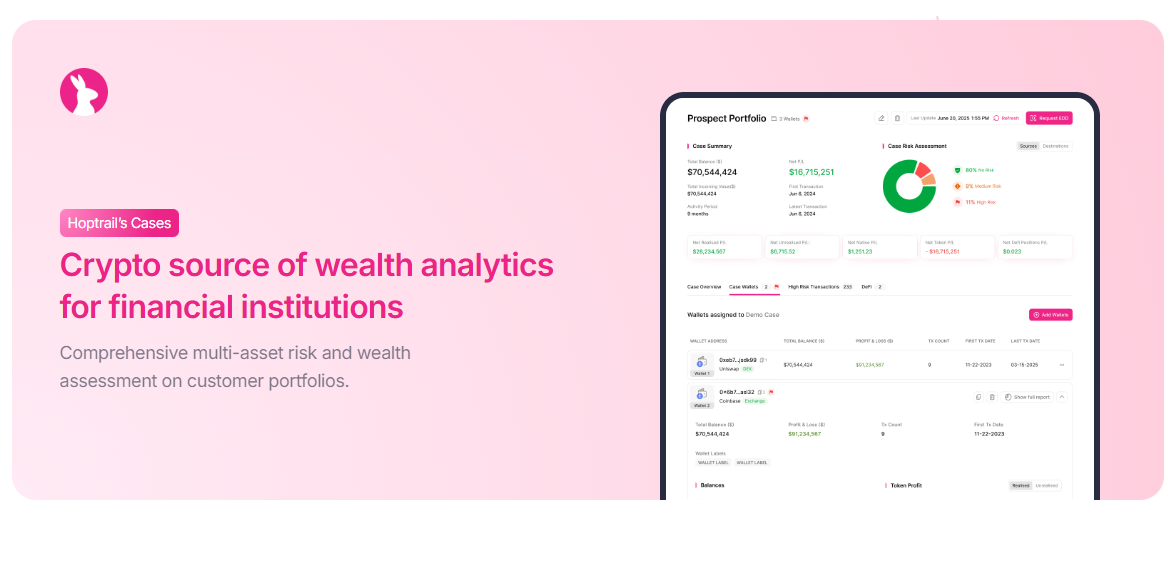

Cases: new source of wealth capabilities and upcoming features

Why we built Cases: A personal note on solving the crypto source of wealth headache

Subscribe to the Hoptrail newsletter

Sign up with your email address to get the latest insights from our crypto experts.